Gold is at all-time highs, analysts are predicting a “super-cycle” for the yellow metal, and junior gold stocks are significantly outperforming senior producers.

The table is set for this under-the-radar junior exploration gem positioned in a Tier-1 mining jurisdiction and neighboring one of the largest undeveloped gold-copper deposits in the world.

We are extremely pleased that every drill hole completed to date has intersected mineralization, with several showing significant widths.

- PJ Murphy, CEO of Forge Resources![]()

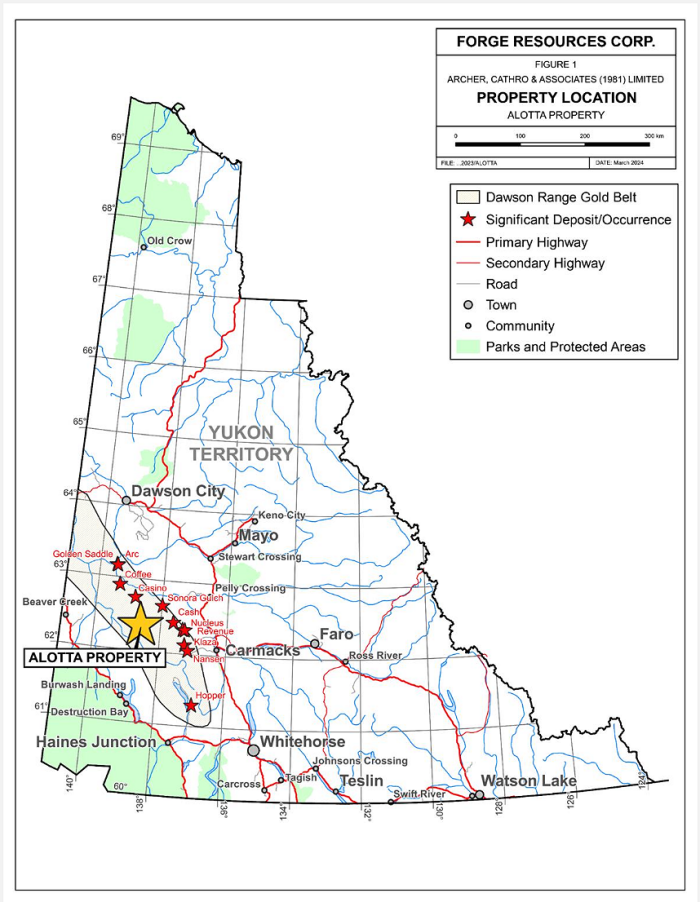

This statement comes from the recently published Investor Deck of Forge Resources Corp (CSE: FRG), a Canadian-listed junior exploration company focused on exploring and advancing the Alotta project, a prospective porphyry copper-gold-molybdenum project consisting of 230 mineral claims that cover 4,723 hectares, and if you have been paying attention to the gold market then you already know this has the potential to catapult the precious metals explorer to new heights.

Over the last several months we have focused heavily junior mining companies and the results have been more than favorable- routinely delivering double and triple-digit winners to our members.

In fact, CSE: FRG is one such company- and we watched it climb a staggering 243% from our initial coverage.

And with the new year bringing with it a highly optimistic outlook for junior mining companies- backed by all-time highs for gold and silver- CSE: FRG is in a strong position to capitalize.

Keep this in mind:

- Junior gold stocks are significantly outperforming senior producers, with the VanEck Junior Gold Miners ETF (GDXJ) seeing massive year-to-date gains in late 2025

Quick Hits that Will be Discussed:

- CSE: FRG neighbors Western Copper and Gold’s Casino project, considered one of the largest undeveloped gold-copper deposits in the world

- Located in the Dawson Range gold belt in Yukon, Canada, CSE: FRG counts multiple multi-billion-dollar majors in their area

- CSE: FRG represents a potentially undervalued opportunity as a junior gold exploration company

- FRG’s initial drill hole completed in the Alimony Zone (hole ALT-25-013) returned encouraging gold values signaling a new exploration target with scale potential beyond the initially drilled areas.

- Noted Canadian mining magnate, investor and co-founder of Franco-Nevada Mining Corporation, Pierre Lassonde, recently stated “The stars for the Yukon are aligned and the time is now.”

- Gold prices have hit all-time highs and experts and analysts continue to share bullish outlooks for the yellow metal, many noting an impending “super-cycle”

- Recent analyst report from Atrium Research places a 1.20 price target on CSE: FRG, suggesting a significant upside from current levels

Let’s dig in.

Forge Resources’ Alotta property sits in the same porphyry/epithermal belt (Dawson Range) that hosts the Casino deposit, a deposit that TSX: WRN has stated contains massive measured and indicated resources.

This may suggest that the geological processes which created a major deposit at Casino also affected Alotta. This can increase the probability of significant mineralization at CSE: FRG’s Alotta property, is located approximately 40 kilometers southeast of Western Copper and Gold’s Casino deposit.

Why it Matters

- It places Alotta in a proven mineral district with world-class potential.

- It supports geological models linking Alotta to large porphyry systems.

- It enhances investor perception and comparables in valuation discussions.

- It helps justify aggressive exploration programs due to analogous geological context

CSE: FRG’s Alotta Exploration Project in the Dawson Range gold belt in Yukon, Canada, is located approximately 40 kilometers southeast of Western Copper and Gold’s (TSX: WRN) Casino deposit, one of the largest undeveloped gold-copper deposits in the world, highlighting its proximity to a globally significant mineral resource.

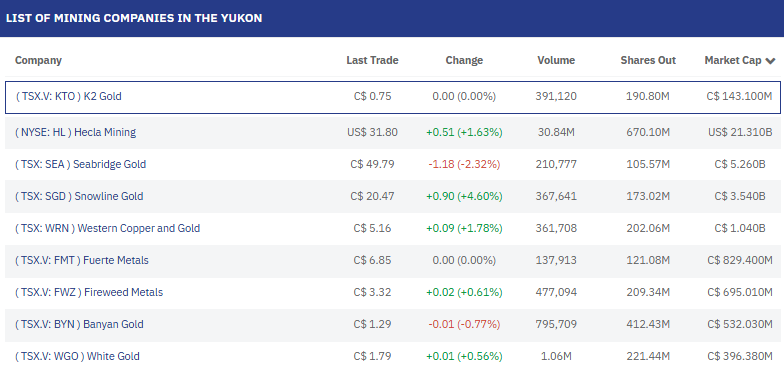

Other majors in the area include:

- Snowline Gold Corp. (SGD.TO) Market Cap 3.017B

- Seabridge Gold Inc. (SEA.TO) Market Cap 4.548B

- Fireweed Metals Corp. (FWZ.V) Market Cap 664.258M

- Banyan Gold Corp. (BYN.V) Market Cap 424.803M

- White Gold Corp. (WGO.V) Market Cap 279.009M

Forge Resources (CSE: FRG), may be an undervalued opportunity.

While FRG is located just 40km southeast of Western Copper and Gold’s (TSX: WRN) Casino deposit and surrounded by multiple multi-billion-dollar companies they are currently valued at a fraction of the market cap.

Initial Drill Results Could Change Current Value:

CSE: FRG recently announced full gold assay results from drill hole ALT-25-012 at their Alotta property Payoff Zone.

Key highlights, based on the company’s December 16, 2025 full-assay release include:

- Broad mineralized interval: 76.93 m @ 2.03 g/t Au from 223.00 m to 301.00 m.

- Higher-grade core within the broad zone: 44.75 m @ 3.40 g/t Au from 256.23 m to 301.00 m.

- Very high-grade interval within the zone: 8.16 m @ 17.71 g/t Au from 284.93 m to 293.10 m.

- Bonanza-grade shoot (composited): 3.15 m @ 45.01 g/t Au from 286.00 m to 289.15 m (within the 8.16 m interval).

- Visible-gold interval: 1.25 m @ 105 g/t Au from 287.15 m to 288.40 m, associated with a low-angle, ~10 cm quartz vein carrying visible gold and bismuthinite plus sulphides.

- Adjacent gold-bearing vein interval: 1.15 m @ 8.85 g/t Au from 286.00 m to 287.15 m, immediately preceding the 105 g/t interval.

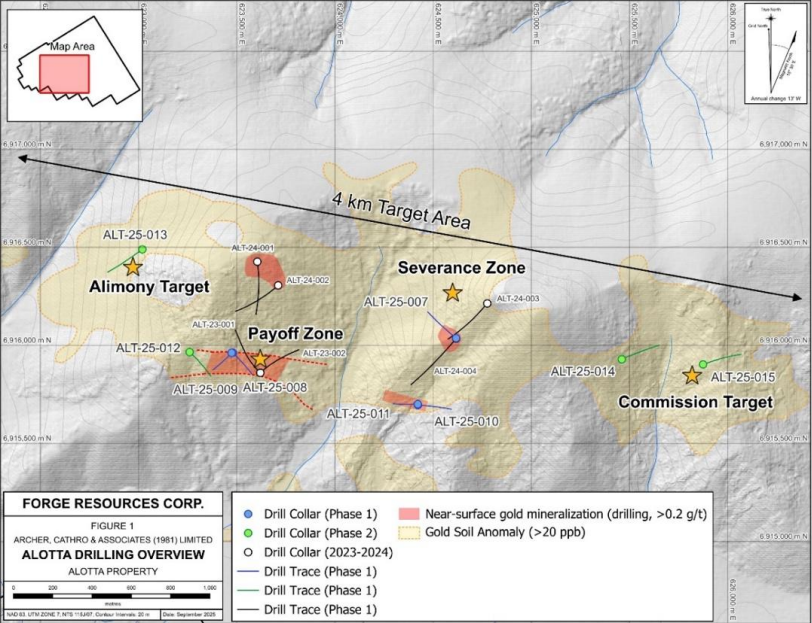

And, CSE: FRG has reported results from drill hole ALT-25-013, the first and only hole drilled at the Alimony Zone.

- Widespread near-surface gold mineralization was discovered, including 112.21 m grading 0.66 g/t Au near surface from 35.29 metres, including 55.52 m grading 1.04 g/t Au and including 1.6 m grading 25.8 g/t Au. All intervals are drilled core lengths.

- The Alimony Zone lies approximately 800 m west of the Payoff Zone (575 m northwest of drill hole ALT-25-012, above). No drilling has been completed between these two zones.

- This drill hole represents a new drilling discovery at the Alotta Project.

“District-Scale”

A total of 2685.66 m of drilling in 9 drill holes were completed by the Company in 2025.

Surface expression of mineralization includes overlapping of gold, copper and molybdenum soil geochemical anomalies that is over 4 km in length and nearly 2 km wide.

The Company was able to successfully test most surface showings, with 2025 holes drilled into the Severance, Payoff, Alimony and Commission zones. These zones are very wide-spread but consistently returned altered and mineralized bedrock confirming a very large system underlies the Alotta property.

CSE: FRG’s Alotta Project has been called District -Scale, meaning:

- A large, continuous mineralized system

- Multiple zones, centers, or targets within one geologic system

- Potential for multiple deposits or a very large deposit

Why this Matters:

- Long mine life potential

- Multiple development paths

- Attractiveness to majors (they look for scale)

- Justification for aggressive drilling

Location, Location, Location

Pierre Lassonde has called Yukon, Canada a prime location for investment due to high-grade discoveries.

And Lassonde’s name carries significant weight.

Pierre Lassonde is a prominent Canadian mining entrepreneur and financier, best known as the co-founder and former president of Franco-Nevada, one of the world’s leading gold-focused royalty and streaming companies. He is widely regarded as one of the most influential figures in modern precious-metals investing and the royalty business model.

Those high-grade discoveries mentioned by Lassonde could deliver considerable returns as he has noted 2026 will bring on a "super-cycle" for gold driven by global fiscal instability and shifting reserve assets.

An image may be worth a thousand words but gold may be worth even more:

- Target of $17,250: Lassonde argues that a peak of $17,250 per ounce is possible in this super-cycle (peaking around 2032), based on the "math" of capital flows moving just 1% of other asset classes into the finite gold market.

- Near-Term Targets: For the next three years, he sees gold rising toward $6,000.

Current Gold Prices and Trends Support Bullish Outlook

The yellow metal continues to top new all-time high, recently crossing the $4,600 per oz. level and there are now signs of that slowing- in fact, current projections stand a good chance at revision considering the aggressive climb we’ve already seen:

- JPMorgan: Expects gold to average $5,055/oz, pushing towards $5,000 by Q4 2026.

- Goldman Sachs: Aims for $4,900/oz, highlighting strong upside if ETF demand increases.

- Morgan Stanley: Forecasts $4,800/oz by late 2026, citing lower rates and central bank buying.

- Bank of America: Raised its 2026 forecast to $5,000/oz, noting strong investment demand and tightening supply.

This all leads to where Forge Resources is heading and with the metals market exploding and recent operational developments tied to their drilling it should come as no surprise to see analysts offering an optimistic outlook.

Following their Dec. 16, 2025 press release announcing drill results Atrium Research issued an analyst report noting:

“As of today’s release, we have upped our overall valuation for Alotta to $35.7M or $0.34/share, from $17.8M previously (this also considers the 60% ownership in the project). This large increase is based on the highly impressive drill results to-date at Alotta with significant gold intersections hit in two different zones as part of this program. Notably, the two gold zones are ~800m apart, providing potential for material size and scale to the Alotta project.”

Within that analyst report Atrium issued a 1.20 price target- marking a significant upside from CSE: FRG’s current standing.

Important links to further your research:

No Guarantee as to Content: Although ED attempts to research thoroughly and present information based on sources we believe to be reliable, there are no guarantees as to the accuracy or completeness of the information contained herein. Any statements expressed are subject to change without notice. The information within this email may contain errors and you should not make any investment decisions based on what you have read herein or read/seen in any of ED’s websites, newsletters, emails, social media, text messages, push notifications, videos and/or other publications. ED, its associates, authors, and affiliates are not responsible for errors or omissions. By accessing the site and receiving this email, you accept and agree to be bound by and comply with the terms and conditions as set out herein. If you do not accept and agree to the terms you should not use the EquityDaily sites or accept this email.

EquityDaily’s electronic media, including websites, newsletters, emails, social media, text messages, push notifications, videos and all other ED published materials are for Canadian residents only.

Consideration For Services. ED, its editor, affiliates, associates, partners, family members or contractors do not have an interest in (CSE:FRG)(OTC:FRGGF). Sponsored Companies that compensate ED may have an interest in (CSE:FRG)(OTC:FRGGF) and will sell (CSE:FRG)(OTC:FRGGF) securities without notice to ED. ED has not been compensated for this report. ED has not been compensated for any emails, text and/or social media posts associated with this report. However, previously, and pursuant to past agreements, ED had been compensated a total of seventy-seven thousand five hundred (77, 500) CAD for email, text and social marketing and awareness consulting for (CSE:FRG)(OTC:FRGGF), which has expired. ED does not investigate the background of any third party. The third party may have shares and will liquidate some or all of them, which will negatively affect the share price. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. We do not own any shares of (CSE:FRG)(OTC:FRGGF). Information provided here within should not be construed as financial analysis but rather as an advertisement. Information provided here within should not be construed as financial analysis but rather as an advertisement.

Conduct your own due diligence: The author’s views and opinions regarding the companies featured in report(s) are his/her own views and are based on information that he/she has researched independently and has received, which the author assumes to be reliable. You should never base any buying/selling/trading decisions off of our emails, newsletters, websites, social media, text messages, push notifications and/or videos or any of our published materials. ED aims to provide information and often stock ideas but are by no means recommendations. The ideas and companies featured are highly speculative and you could lose your entire investment – consult a licensed financial advisor if you are considering investing in any of the featured companies. Subscribers/readers are encouraged to conduct their own research and due diligence. The companies mentioned are high risk and considered penny stocks that contain a high risk of volatility, therefore consult a licensed investment advisor and do your own due diligence. Never base any investment decision on information contained from our emails, newsletters, websites, social media, text messages, push notifications, videos or any of our published materials.

No Recommendation to Purchase or Sell Securities: ED is not a registered broker dealer, investment advisor, financial analyst, stock picker, investment banker or other investment professional. ED is intended for informational, educational, research and entertainment purposes only. It is not to be considered as investment advice. No statement or expression of any opinions contained in this email/report constitutes an offer to buy or sell the shares of the companies mentioned herein.

Links: ED and/or ED’s publications may contain links to related websites for stock quotes, charts, etc. ED is not responsible for the content of or the privacy practices of these sites. Information contained herein was extracted from public filings, profiled company websites, and other publicly available sources deemed reliable. Information in this report was taken on or before writing and dissemination and may not be updated. Do you own due diligence as information and events can and do change. Published reports may reference company websites or link to company websites and you agree that ED is not responsible for the content and accuracy of any such information or website.

Release of Liability: By reading/viewing materials on our websites, emails, newsletters, social media, text messages, push notifications and/or watching videos by ED, you agree to hold ED, its associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

Forward Looking Statements: Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by the use of certain terminology, including “will”, “believes”, “may”, “expects”, “should”, “seeks”, “anticipates”, “has potential to”, or “intends’ or by discussions of strategy, forward looking numbers or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which will cause the actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company’s business model; future operations, products and services; the impact of regulatory initiatives on the Company’s operations; the size of and opportunities related to the market for the Company’s products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance. ED does not take responsibility for the accuracy of forward looking statements and advises the reader to perform their own due diligence on forward looking numbers or statements.

RECENT PRESS RELEASES

December 16, 2025